Okay so now we're going to be looking at form with 166 k in forum DES 156 so let's go to squad-- serial it sees my pops up 60s 156 okay I never thinks application yes 16 and uh let's see can't cancel this is BS 156 k this is for you sweetie yes 1626 so will tell you have to say you know tell the truth and give the imagination on this yeah I'm going to hang and this is if it's like status um and a question is presently married how we can rare US citizen Beyoncé explain okay no no pres married anyone they're not eligible for a fee, so they lay a little trap for you, they're going to get a kiss you all right you're married this list a date of birth of all in very children under 21 years age nine but will accompany you or will follow you again they're looking to find out if they're going to complete you or what the following documents must be tested or 2i × 40 on tight on entry visa hey birth certificate evidence of age mañana say evidence in financial support or source decreed death certificates of spouse for certificates of all children listed number I get another little mini checklist we're going to all this stuff happening um all the documents who also be my part by the system integration services when you I for Justin that is lawful manner resident USCIS except sometimes without that, so the email heads up after you can end up carrier a fiancé visa you know in the United States and you marry within a day the next thing Justin that as the resident you need all the stuff over again tonight here's a little statement here that...

PDF editing your way

Complete or edit your DS-156-E 2013 Form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export DS-156-E 2013 Form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your DS-156-E 2013 Form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your DS-156-E 2013 Form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about DS-156e

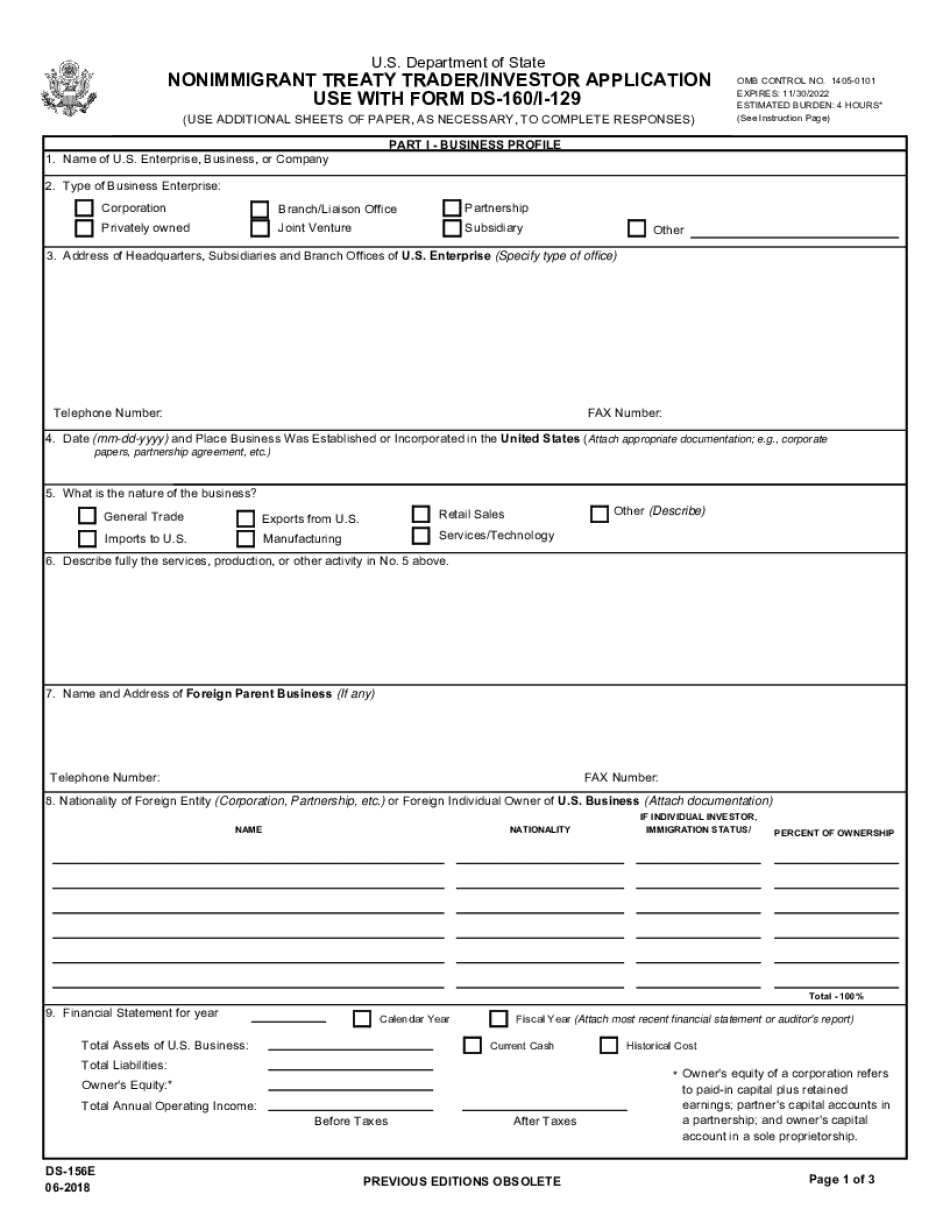

- The DS-156e form is part of the application for an E-1 Treaty Trader or E-2 Treaty Investor Nonimmigrant Visa.

- The form must be updated periodically.

- Evidence of substantiality, financial statements, and audits are required for the visa application.

Award-winning PDF software

How to prepare DS-156e

About DS-156-E 2025 Form

The DS-156-E 2025 Form is an application form used by individuals who are applying for a nonimmigrant visa to enter the United States. It is specifically designed for those who are seeking an exchange visitor (J visa) status, which includes individuals participating in educational, cultural, and professional exchange programs. The form collects information about the applicant's personal details, educational background, program details, and any previous immigration violations or criminal records. It also includes questions related to the applicant's intention to return to their home country after completing the program in order to ensure that they have no immigrant intent. Any individual who is applying for a J visa to participate in an exchange program in the United States is required to complete and submit the DS-156-E 2025 Form. This applies to individuals of all age groups, including students, scholars, interns, teachers, trainees, research assistants, and other participants in exchange programs.

People also ask about DS-156e

What people say about us

E-forms raise overall performance

Video instructions and help with filling out and completing DS-156e